Divorce will be emotionally difficult, and dividing belongings, particularly property, provides complexity. When you personal property collectively, transferring fairness could also be vital. Understanding this course of is significant earlier than making choices.

On this article, we’ll information you thru the fairness switch course of, serving to you navigate this vital step confidently.

What’s Fairness Switch in a Divorce?

Transfer of Equity is the method of adjusting property possession from one particular person to a different. In a divorce, this sometimes happens when one partner transfers their share of the property to the opposite.

It’s a typical technique for dividing belongings, notably when a pair owns a house collectively. Primarily, transferring fairness permits one partner to “purchase out” the opposite’s share, guaranteeing each events obtain a good portion of the marital belongings.

Key Concerns Earlier than Agreeing to Phrases

Earlier than you conform to any phrases relating to the switch of fairness, it’s vital to consider a number of components:

1. Valuation of the Property

You’ll have to know the present market worth of the property. That is important in figuring out how a lot fairness every particular person holds and the way a lot must be transferred. Getting an expert property valuation is a brilliant transfer.

2. Excellent Mortgages or Money owed

If there’s an excellent mortgage on the property, this must be taken into consideration. The particular person receiving the fairness switch could should tackle the mortgage funds, or the mortgage is perhaps paid off utilizing different belongings. Make certain to make clear this side to keep away from future monetary pressure.

3. Authorized and Tax Implications

Transferring fairness in a divorce could have tax implications. You don’t pay Stamp Responsibility Land Tax (SDLT) if the switch is made between spouses as a part of a proper settlement or courtroom order associated to divorce, dissolution, annulment or authorized separation. Nevertheless, it’s vital to seek the advice of a solicitor or tax advisor to know these particulars and keep away from sudden prices.

4. Future Monetary Stability

Contemplate how this fairness switch will influence your future monetary stability. Will taking up the total mortgage or the prices of the house go away you financially safe? Make sure that you’re making a call that received’t trigger monetary pressure down the road.

The Technique of Transferring Fairness

Step 1: Settlement Between Events

Each spouses should come to an settlement concerning the phrases of the fairness switch. This contains deciding who will maintain the property, what quantity of fairness will likely be transferred, and the way any excellent money owed will likely be managed.

Step 2: Authorized Formalities

You’ll want to finish the required authorized paperwork, which usually features a deed of switch. This doc formalises the switch of fairness and should be signed by each events. A solicitor can assist be sure that the paperwork is right.

Step 3: Land Registry

As soon as the switch is agreed upon, the main points should be registered with the Land Registry to replicate the change in possession. This step ensures that the brand new possession is formally recognised.

Conclusion

Transferring fairness in a divorce is essential for dividing belongings pretty. It’s vital to know the method, together with components like property valuation, mortgages, and potential tax implications. Search skilled recommendation to make the method smoother. Earlier than agreeing to phrases, make sure you’re knowledgeable about how the switch will have an effect on your funds and future. When you want help, consulting a solicitor is smart to make sure every part is dealt with accurately and legally.

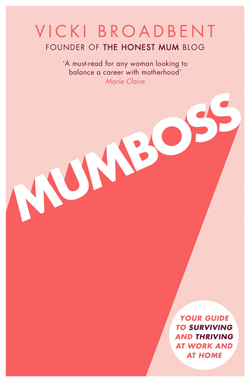

Purchase my bestselling ebook in paperback or audio

My debut ebook is my information to surviving and thriving at work and at house and affords perception into create a digital enterprise or return to work with confidence.

Mumboss: The Sincere Mum’s Information to Surviving and Thriving at Work and at Dwelling

(UK 2nd Version)

Accessible on Amazon or Audible

The Working Mother: Your Information to Surviving and Thriving at Work and at Dwelling

(US/Canada Version)

Accessible September eighth 2020. Order now on Amazon