Smart financial decisions will not be about incomes six figures or ready for the ‘excellent time’ to speculate. Good habits make life simpler. They aid you save extra, stress much less, and plan for the longer term.

These six monetary strikes can set you on the fitting path. Whether or not you might be simply getting began or seeking to enhance your funds, they may aid you construct wealth, keep away from widespread errors, and keep safe. Let’s get into it.

1. Construct an Emergency Fund

Life is unpredictable, and surprising bills can come up at any time. An emergency fund acts as a monetary cushion, stopping you from dipping into financial savings or accumulating debt when confronted with sudden monetary burdens, reminiscent of medical emergencies, automotive repairs, or job loss.

How one can Get Began

- Goal to avoid wasting not less than three to 6 months’ price of residing bills.

- Maintain the funds in a high-yield financial savings account for simple entry.

- Automate transfers out of your paycheck to make sure constant contributions.

Having an emergency fund offers peace of thoughts and monetary safety, permitting you to navigate challenges with out derailing your monetary targets.

2. Pay Off Excessive-Curiosity Debt

Debt generally is a main impediment to monetary freedom, particularly with regards to excessive rates of interest. Bank card debt, private loans, and payday loans can rapidly accumulate and grow to be troublesome to handle. Debt reimbursement can liberate money circulation and enhance your monetary well being.

Sensible Methods

- Use the debt snowball technique, the place you repay the smallest money owed first for fast wins and motivation.

- Think about the debt avalanche technique, specializing in the very best rate of interest money owed first to minimise curiosity funds.

- Consolidate high-interest debt with a lower-interest private mortgage or steadiness switch bank card.

Decreasing debt lets you reallocate funds in direction of financial savings, investments, and different monetary targets.

3. Put money into Retirement Accounts Early

Time is your biggest asset with regards to investing. The sooner you begin saving for retirement, the extra you profit from compound curiosity. Even small contributions can develop into a major nest egg over time.

Finest Practices

- Contribute to employer-sponsored retirement plans, reminiscent of a 401(k), particularly if there’s a matching program.

- Open an IRA (Particular person Retirement Account) to benefit from tax advantages.

- Enhance contributions regularly as your revenue grows.

Persistently investing in retirement accounts ensures monetary safety in your later years and reduces the necessity for monetary dependence.

4. Diversify Your Investments

Placing all of your cash in a single place is dangerous. Diversification spreads danger throughout totally different asset lessons, defending your portfolio from main losses if one funding underperforms.

Methods to Diversify

- Put money into a mixture of shares, bonds, actual property, and mutual funds.

- Think about index funds and ETFs for low-cost, broad-market publicity.

- Rebalance your portfolio periodically to keep up your required degree of danger.

A well-diversified portfolio maximises progress potential whereas minimising danger, serving to you obtain long-term monetary stability.

5. Prioritise Property Planning

Many individuals assume property planning is just for the rich, however in actuality, anybody with property wants a structured plan. Easy oversights can result in main monetary penalties for family members. To keep away from these widespread estate planning mistakes, it’s a sensible transfer to evaluate your plan with a monetary professional.

Key Steps

- Draft a will to specify how your property can be distributed.

- Set up an influence of legal professional to make sure somebody can handle your funds for those who grow to be incapacitated.

- Create a residing belief for extra management over your property and to keep away from probate delays.

Property planning ensures your property are distributed based on your needs whereas minimising tax burdens and authorized problems to your heirs.

6. Constantly Educate Your self on Private Finance

Monetary literacy is a lifelong journey. The extra you perceive about managing cash, the higher geared up you might be to make knowledgeable selections.

How one can Keep Knowledgeable

- Learn books and hearken to podcasts on private finance.

- Comply with respected monetary blogs and information sources.

- Attend workshops or seek the advice of a monetary advisor for personalised steerage.

Staying educated on monetary issues empowers you to take management of your monetary future, keep away from widespread pitfalls, and maximise wealth-building alternatives.

It’s okay to not know every thing about finance, particularly for those who’re keen to be taught. In the event you’re not sure about one thing, ask for recommendation from somebody you understand and belief or attain out to free monetary recommendation providers:

- MoneyHelper – A government-backed service that gives free and neutral monetary steerage.

- Citizens Advice – A community of unbiased charities within the UK providing free and unbiased recommendation on a variety of matters, together with cash.

- StepChange – The UK’s largest debt charity providing free and neutral debt recommendation on-line and by way of cellphone.

- National Debtline – A free and confidential debt recommendation charity run by the Cash Recommendation Belief.

- Turn2Us – A nationwide charity that gives sensible assist with cash

Ultimate Ideas

Making sensible cash selections doesn’t require large wealth or experience—only a dedication to considerate planning and constant motion. By constructing an emergency fund, eliminating high-interest debt, investing early, diversifying property, prioritising property planning, and repeatedly studying, you set your self up for long-term monetary success. Begin implementing these steps at this time to take cost of your monetary future!

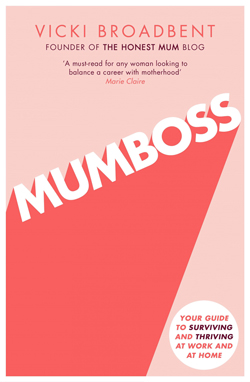

Purchase my bestselling ebook in paperback or audio

My debut ebook is my information to surviving and thriving at work and at house and provides perception into tips on how to create a digital enterprise or return to work with confidence.

Mumboss: The Trustworthy Mum’s Information to Surviving and Thriving at Work and at Residence

(UK 2nd Version)

Accessible on Amazon or Audible

The Working Mother: Your Information to Surviving and Thriving at Work and at Residence

(US/Canada Version)

Accessible September eighth 2020. Order now on Amazon